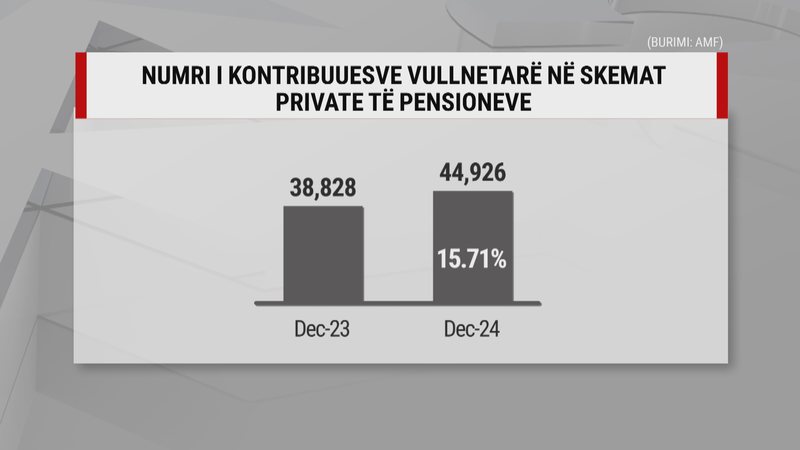

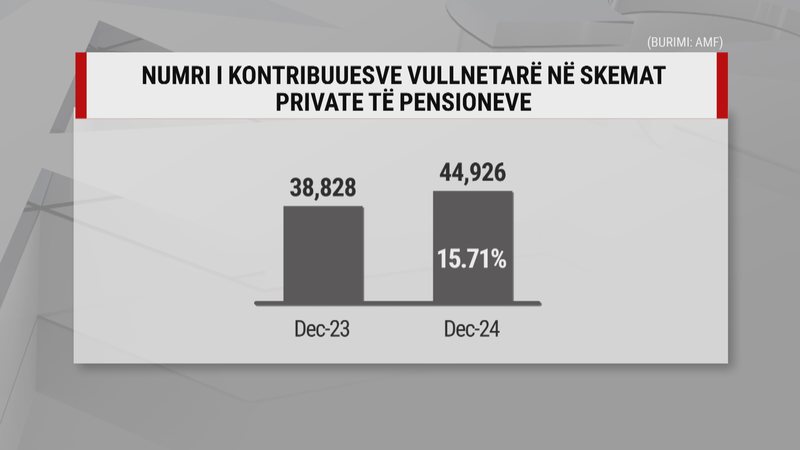

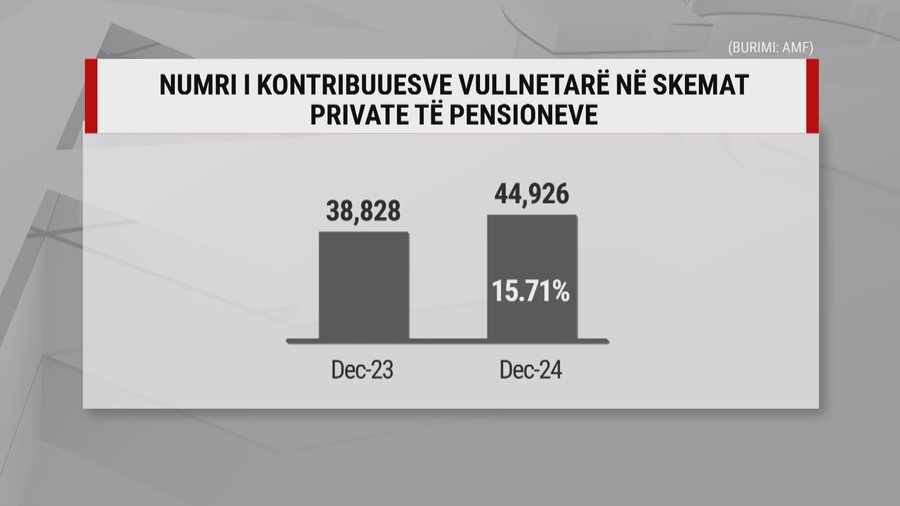

Albanians are investing to "age with dignity". Economic uncertainties, coupled with the rapid aging of the population on the one hand, and the fact that what the elderly in the country receive is not enough, are pushing citizens towards private pension schemes. From just over 38 thousand at the end of 2023, the number of those contributing voluntarily reached almost 45 thousand in December 2024.

"The latest law regulating the voluntary private pension scheme has made it possible and has created some incentives for some employees who enter these schemes. On the other hand, the law has also created facilities for employers to make a deductible part of the employees' salary. This has led to an increase in the number of interested parties," declared Avni Ponari, an entrepreneur in the insurance market.

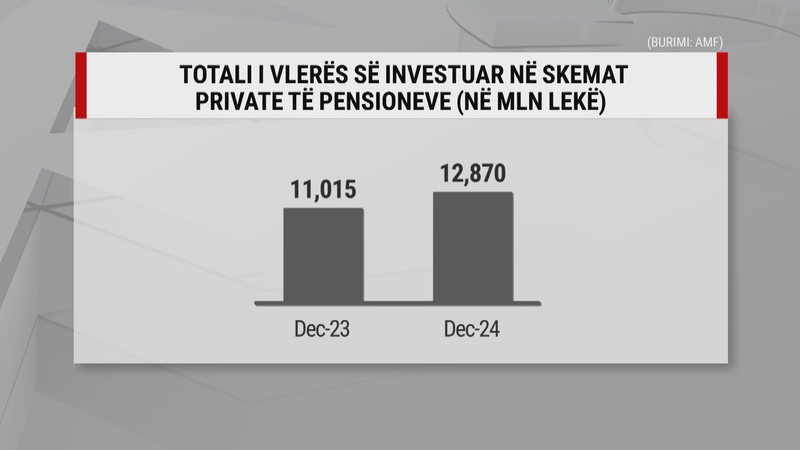

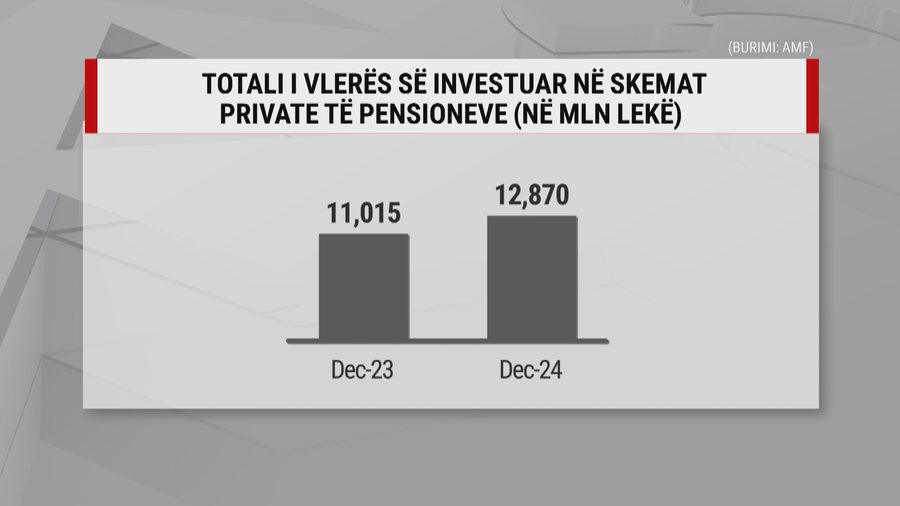

Data from the Financial Supervisory Authority shows that the value of money invested in private pension schemes at the end of last year reached almost 12.9 billion lek, expanding by 16.8 percent compared to 2023.

But is it worth investing in private schemes and how much could the pension that the elderly person will receive when they reach retirement age be?

"It starts from 30-40, 50 or even 70 thousand lek from the private voluntary scheme and 20-30 thousand lek from the public one. In the end, the one who retires receives about 1 million old lek per month," emphasizes Avni Ponari, an entrepreneur in the insurance market.

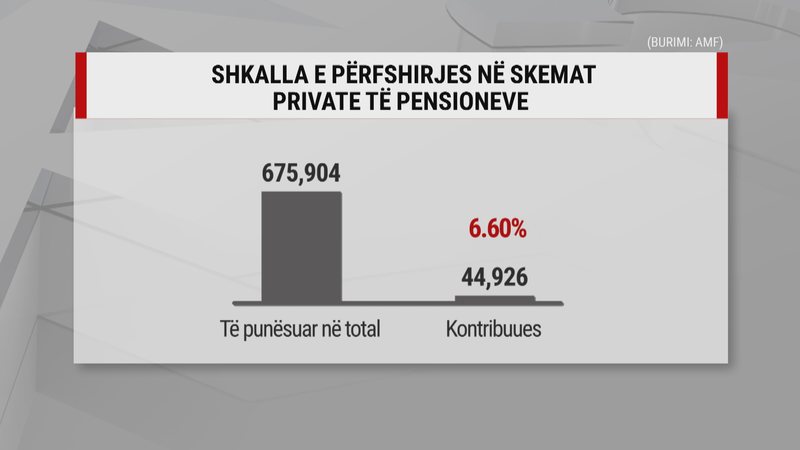

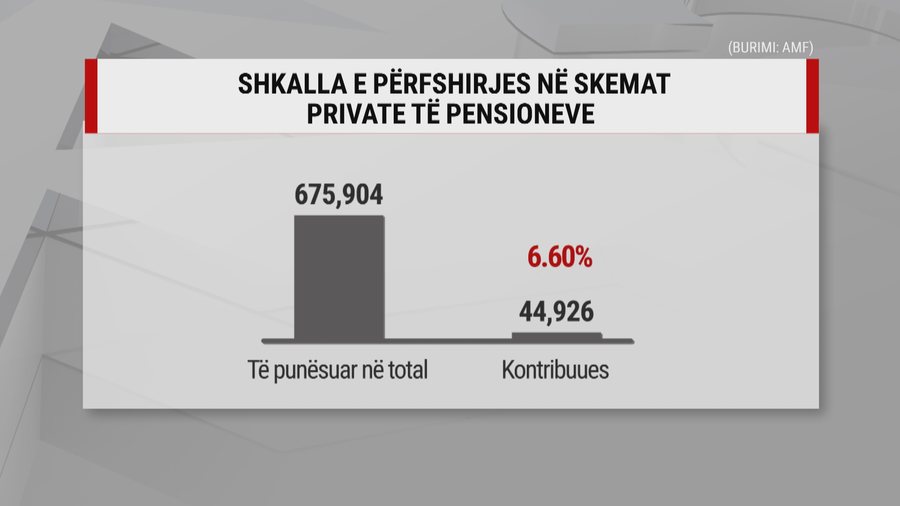

Despite steady but slow growth, currently only 6.6 percent of employees earning a monthly salary contribute to private pension schemes. As in any market, there is mistrust here too.

"We don't trust these. If I have money, I'd rather put it in the bank than in voluntary pensions," citizens say.

The need for more awareness is also acknowledged by insurance market actors themselves.

"We need to start with awareness. Like everything new, the private voluntary pension scheme is also prejudiced. We need to learn not to prejudice everything," says Avni Ponari.

Data from the Financial Supervisory Authority shows that currently, the majority of those involved in voluntary pension schemes are women. Meanwhile, representatives of the insurance market say that for it to develop, the pension scheme needs to be extended with a mandatory "second pillar", a combination of the state and the private sector. (A2 Televizion)