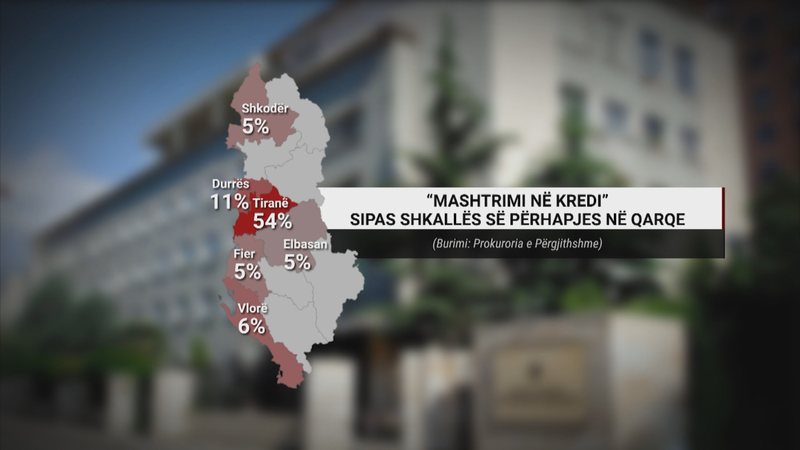

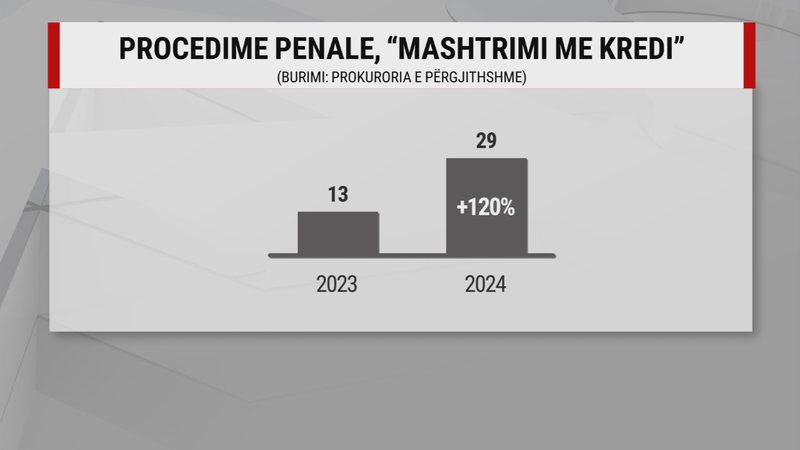

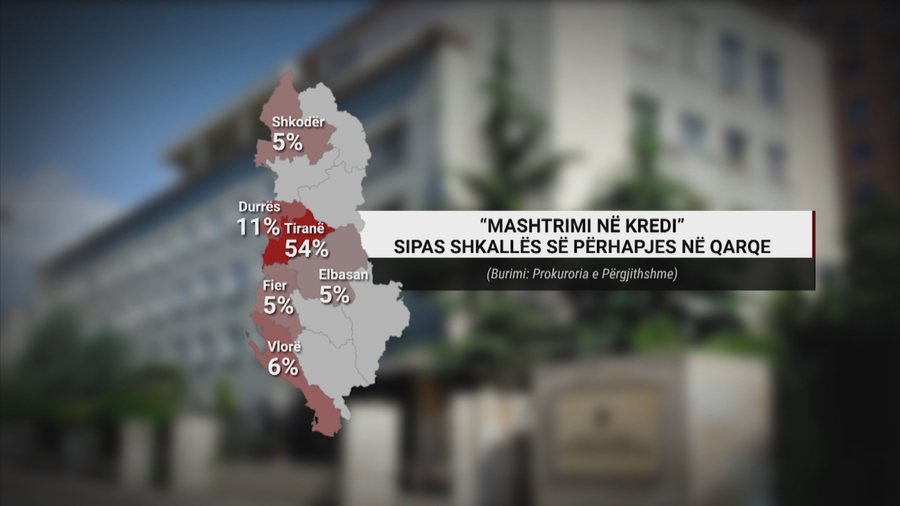

More than half in Tirana, followed by Durrës, Vlora, Shkodra, Fier and Elbasan... the "Loan Fraud" fraud scheme continued last year.

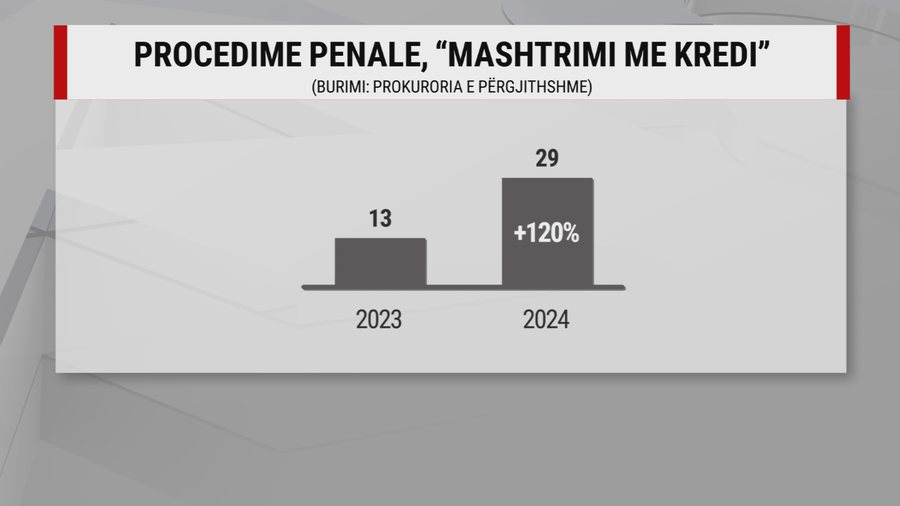

With forged documents or other people's means of identification, at least 29 people obtained loans from banks and other financial institutions.

"These criminal offenses have become a concern for some banks and non-bank financial entities, not only because of the economic damage suffered, but also because of the considerable reputational damage. Artificial intelligence has also been introduced into the world with the aim of scanning people who take out loans," economic expert Eugen Musta told A2 CNN.

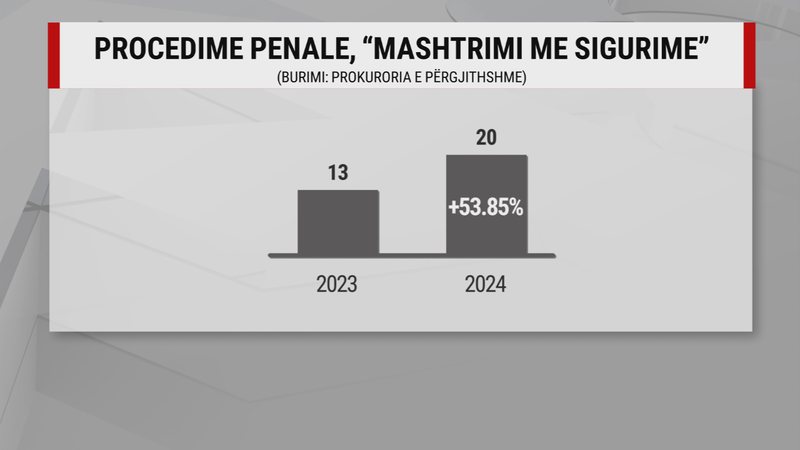

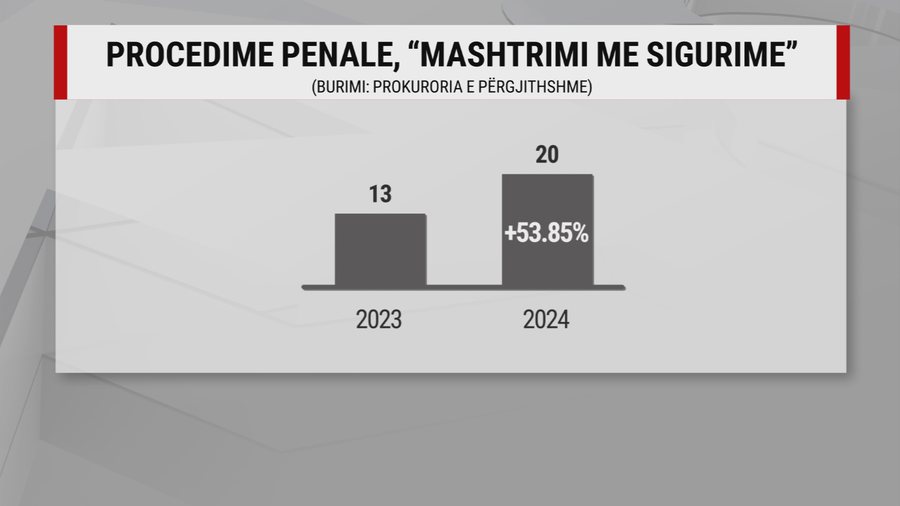

In addition to loans, fraud last year also extended to insurance. From road accidents, fire and flood damages, 20 people tried to deceive insurance companies last year to benefit from undeserved amounts. Compared to 2023, the number of proceedings for this criminal offense increased by about 54 percent.

"Article 145 of the Criminal Code defines insurance fraud as presenting false circumstances regarding the object being insured, or creating false circumstances and presenting them in documents to unfairly benefit from insurance. This criminal offense is punishable by a fine or imprisonment of up to five years," Musta added.

Data from the General Prosecutor's Office shows that about 80 percent of those 1% who defraud with loans or insurance are men. (A2 Televizion)