Albanian citizens and entrepreneurs knocked on the doors of banks more often in the first quarter of the year. But due to historical "prices", a significant portion of loan requests were rejected.

The approval rate for loans to businesses was reported to be lower in the first quarter. Factors included credit history, disposable income and financial statements of businesses. The approval rate for loans to individuals was reported to be down in the first quarter of 2025, writes A2 CNN. The increase in the rejection rate was caused by banks' policies regarding required collateral.

Bank of Albania

While predicting that demand for credit will remain high from both citizens and businesses, the Bank of Albania predicts a reduction in rejections.

In the second quarter of the year, banks expect to pursue more relaxed lending policies in the small and medium-sized business segment, in loans issued for the purpose of financing investments and those to cover short-term liquidity needs. Lending policies are also expected to be easing in the segment of loans for the purchase of housing.

Bank of Albania

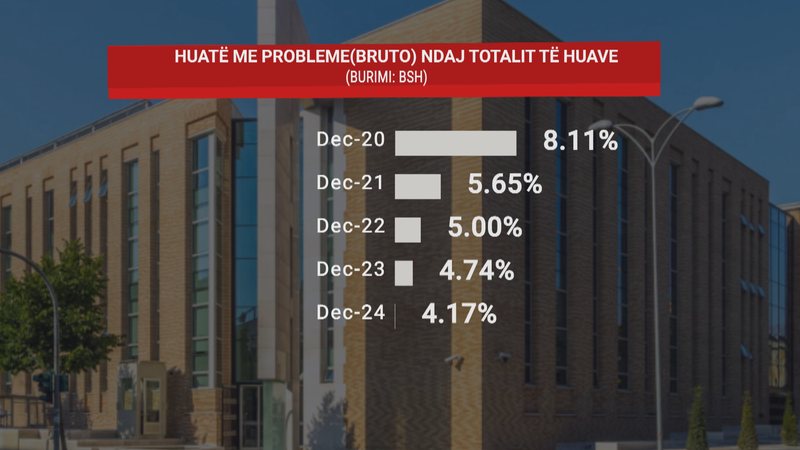

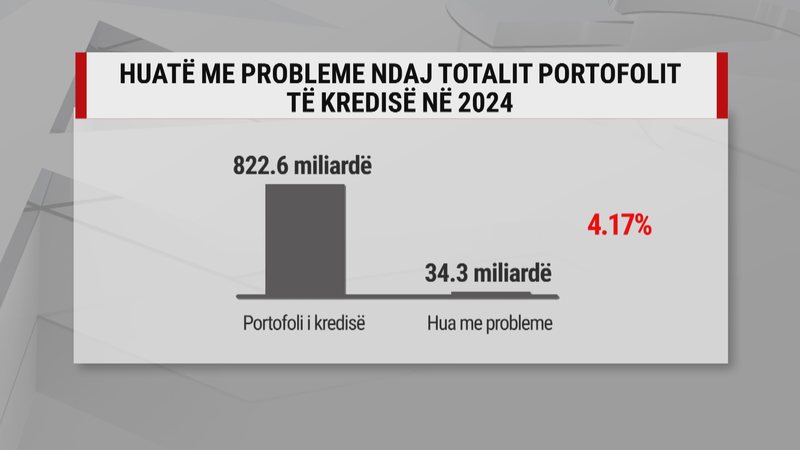

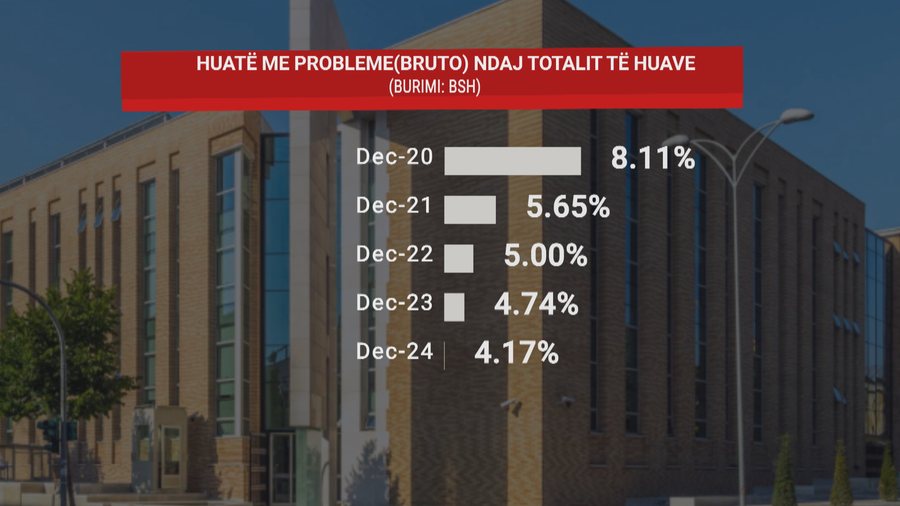

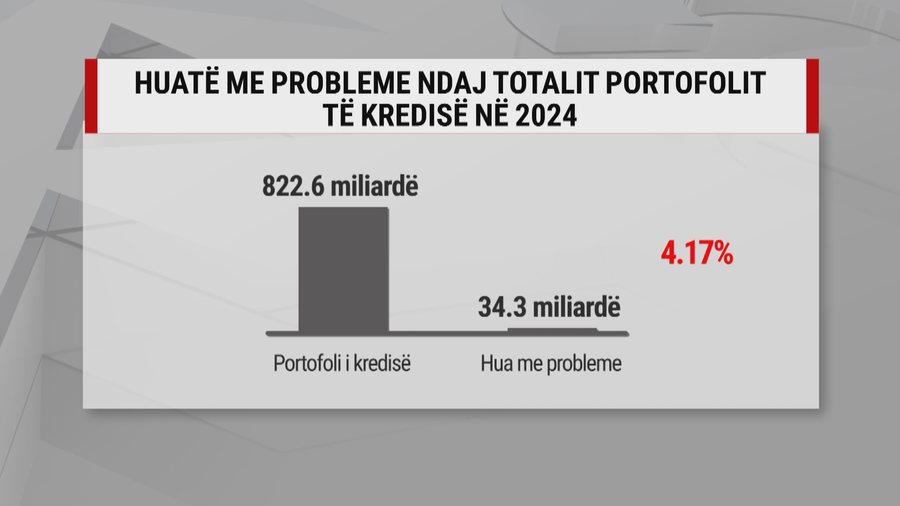

The easing of lending conditions, according to the Central Bank, will come as a result of a significant reduction in the level of bad loans. Data from the Bank of Albania show that only 4.17 percent of total loans taken from banks have not been paid on time.

"We hope we don't have a crisis in real estate because if it starts, the exposure will be not only of the individual but also of the banks that have taken collateral for these loan-financed objects. And then we will have the situation of not covering the loans given with collateral. Where the banks will again ask them to cover it or give up the properties and be left with unpaid debts," says economic expert Selim Blliku to A2 CNN.

Data from the Central Bank shows that the total loan portfolio provided by the 11 commercial banks in the country was 822.6 billion lek. Of this amount, 34.3 billion were loans not repaid on time.

The decline in the indicator to the lowest level in 16 years has come from both the regular repayment of old loans and the expansion of new loans. (A2 Televizion)