Getting a loan is part of many people's daily lives to achieve many goals, such as buying a house, other goods, completing studies or even vacations. This process also has rules that must be understood before taking any action, such as signing the contract. The latter must be read and understood well before making any kind of commitment.

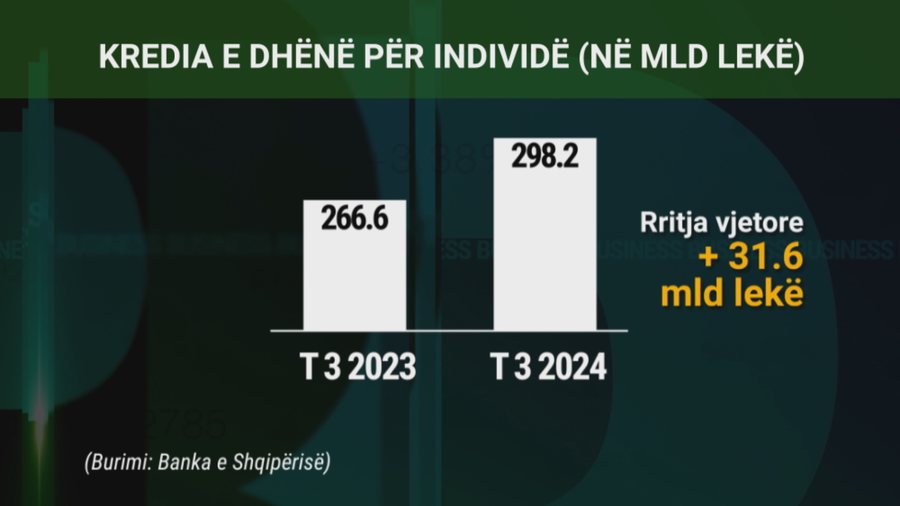

Data show that loans to individuals reached over 298.2 billion lek at the end of September last year, an increase of 31.6 billion compared to the same period a year earlier.

Citizens take out loans for various purposes.

Most of them take out loans to buy a house, as not everyone has the money in savings. Some also take out loans for daily needs, or in other words, consumer loans.

But obtaining a loan has several conditions that must be met, and it is important for the borrower to know and understand them.

First, there must be sufficient income to pay the loan and continue living normally. Second, there must be collateral or otherwise a property that can be blocked by the bank as a guarantee. This is in the case of buying a house with a loan, but not necessarily when taking out a consumer loan. The third condition is a clean history. In other words, the citizen must have been regular in repaying previous loans if he had any. (A2 Televizion)