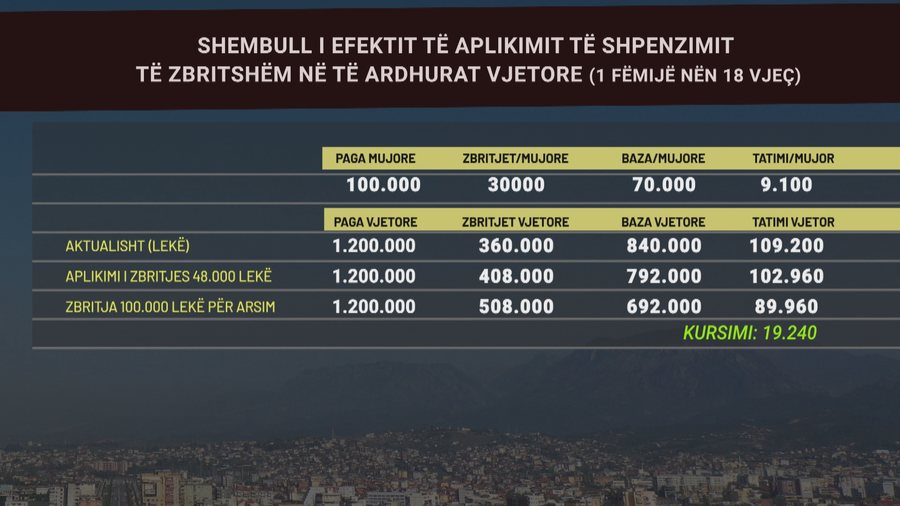

Starting next year, one of the parents with children under 18 will have 48 thousand lek automatically deducted from the taxable base when filling out the Personal Income Declaration. If his or her gross monthly salary during 2025 was 150 thousand lek, resulting in an annual income of 1 million and 800 thousand lek, deducting 30 thousand lek each month as the non-taxable portion... the obligation for 12 months is calculated at 187 thousand and 200 lek. But by also deducting the amount of 48 thousand lek per year for the child in care, the annual tax drops to 180 thousand and 960 lek. So, this employed individual will pay 6 thousand and 240 lek less in tax, which consequently translates into more money in their pockets.

"It is a value that we have calculated for 500 thousand children according to the last Census and that their parents can benefit from. The one who has the highest income and if we were to do it for all 500 thousand children, I believe it could reach... these are preliminary values, but it could reach up to 20 million euros," says the General Director of the DPT, Ilir Binaj, for A2 CNN.

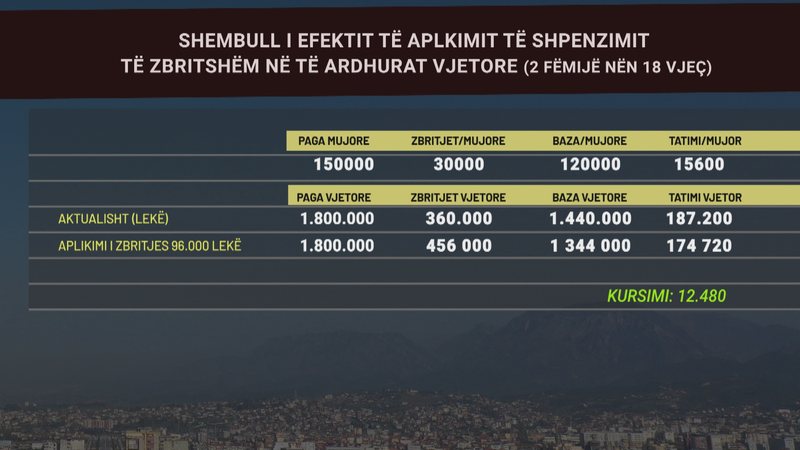

The same logic applies to families with two children under 18. The annual deductible expenses in this case are calculated at 96 thousand lek. So a parent with the same salary, 150 thousand lek per month, will pay annual tax in the amount of 174 thousand and 720 lek... 12 thousand and 480 lek less than they would receive if they did not have minor children in care.

"This is a way that is done in many countries. I have seen it in America. It is a way that you will in some way help families with many children... since the financial situation of many families is also different from the other and definitely those with more dependent children should have more help," Binaj emphasizes for A2 CNN.

Meanwhile, after the positive performance during 2024, the tax administration is continuing to perform well this year in terms of revenue collection.

"The first four months resulted in growth. So the Tax Administration was able to collect about 12 million euros more than planned and about 160 million euros more than in the same period last year," adds the Director General of the DPT to A2 CNN.

Meanwhile, the General Directorate of Taxes is also preparing for the implementation of the government's initiative for "Fiscal Peace" with businesses, which is expected to begin implementation soon.

"As soon as it becomes law, we will implement it immediately. The Tax Administration has experience in this regard and we will have no problems," Binaj emphasizes to A2 CNN.

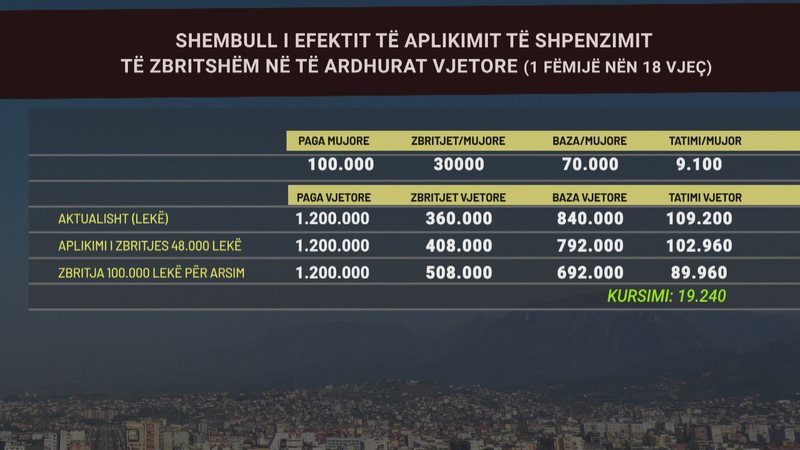

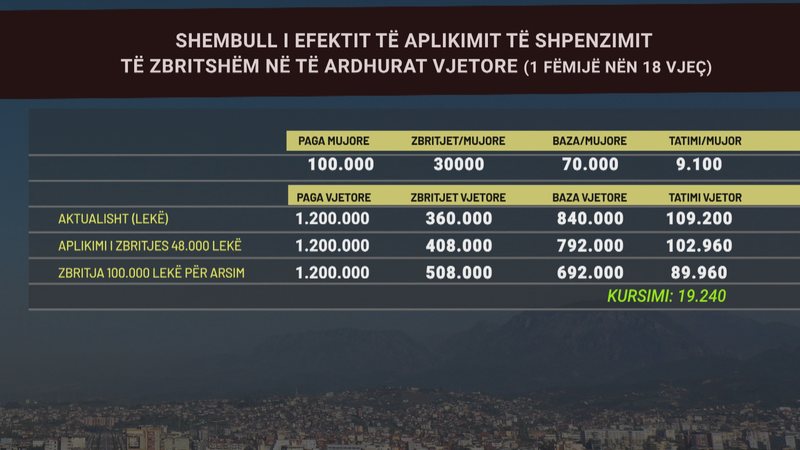

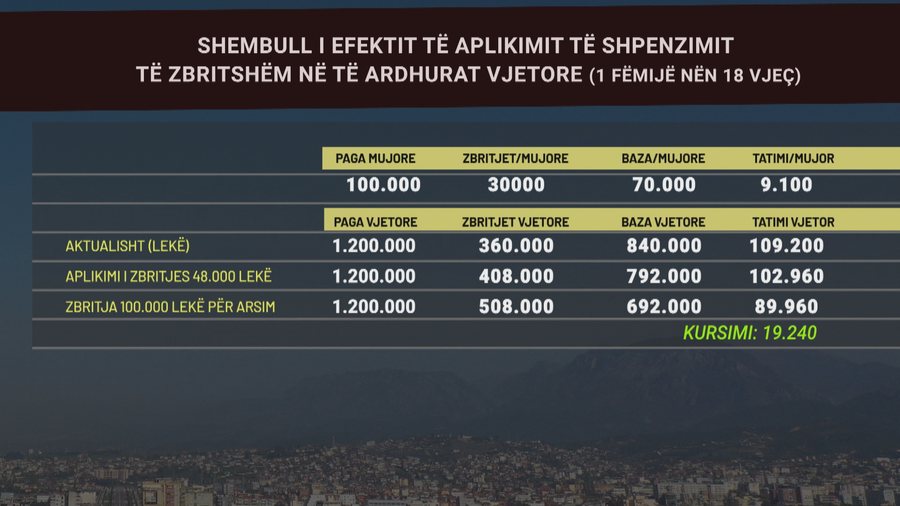

Meanwhile, starting next year, for parents with an annual income of no more than 1 million 200 thousand lek per year, deductible expenses for children's education will also be applied at a maximum of 100 thousand lek. So, the parent will not pay 109 thousand 200 lek in tax per year, but 89 thousand 960, thus saving 19 thousand 240 per year.

(A2 Televizion)