Non-bank financial institutions, otherwise known as microfinance, are increasingly providing loans, driven by high demand, especially in some sectors that are not covered by bank loans, such as agriculture and livestock, or even individuals.

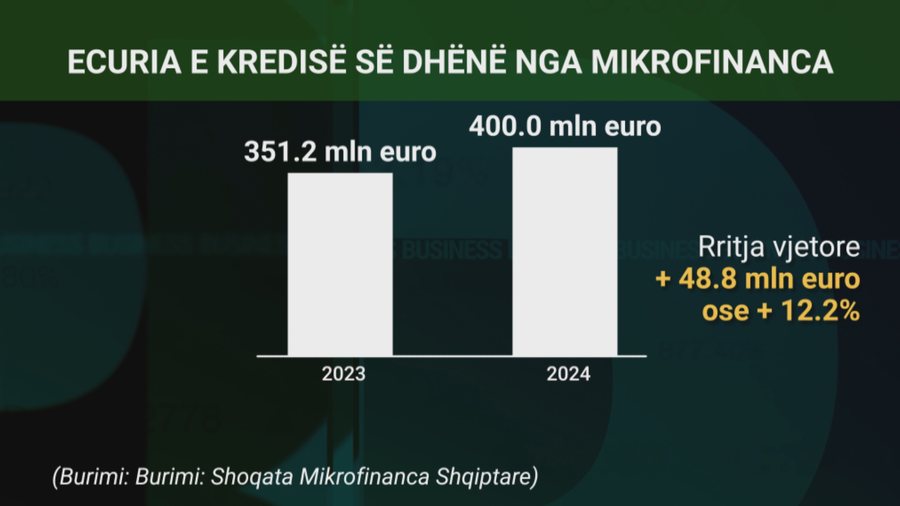

Data shows that during 2024, about 400 million euros in loans were provided by microfinance, an increase of 12.2% compared to the previous year.

But who was financed with this money?

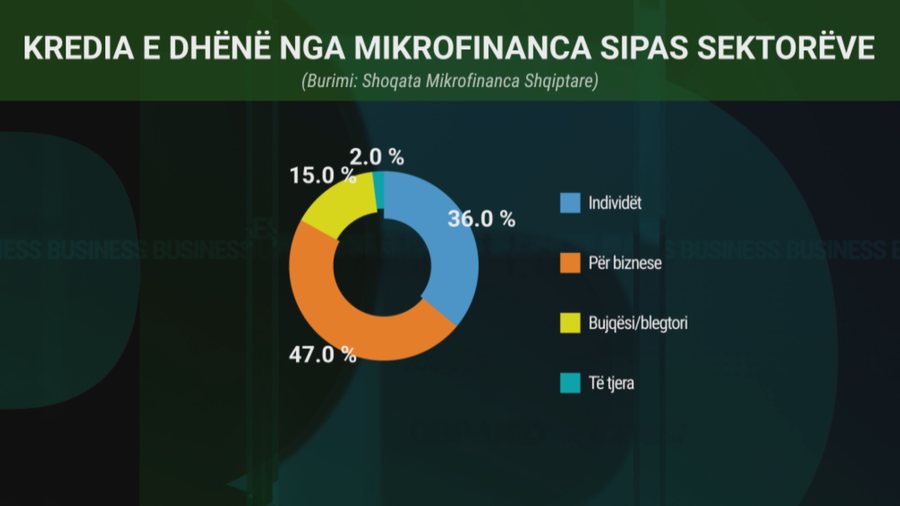

The most heavily lent are businesses with 47% of the total, followed by individuals with 36% of the total loans granted. In third place is the agriculture and livestock sector with 15% of the total.

The demand for loans from non-bank financial institutions remains significant, despite high interest rates compared to the banking system. This is due to the higher risk, faster loan disbursement, but also the fact that they do not use customer deposits, as in the case of banks, but rather investor funds.

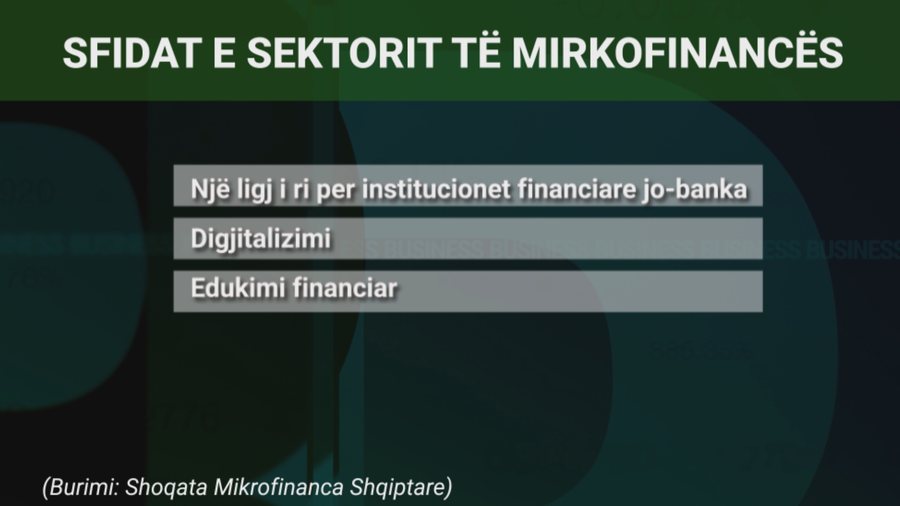

The sector, often criticized precisely because of expensive loans, faces several challenges today.

The most important are a new law for this sector; digitalization, as well as financial education issues, to be better understood by the public, but especially by clients. (A2 Televizion)